Are you a site builder planning on flipping your site for that big payout? If so, you have a few options when it comes to where to sell your website.

Right now, I think the two most popular brokers are Empire Flippers (EF) and FE International (FEI). I’ve used both multiple times and I want to highlight for you how they’re different to help you decide who to sell with.

Just this year, in Q1 and Q2 2019, I have sold a site with each of these brokers so that I can tell you exactly how they differ.

I’m not going to tell you which of the two that I prefer, so that you can make your own decision. And some things about the experiences I cannot legally tell you due to a NDA.

Getting Started With A Broker

Signing up with each of the brokers is a very similar process that starts on each of their respective websites.

With FEI, you visit this page and enter your info in their “Get Your Valuation” form.

With EF, you visit this page and click on “List Your Online Business” and enter in all the required info to get started. Then, you have to pay the listing fee (which is refunded if you don’t pass their vetting).

What Happens After You Express Interest In Listing With Them?

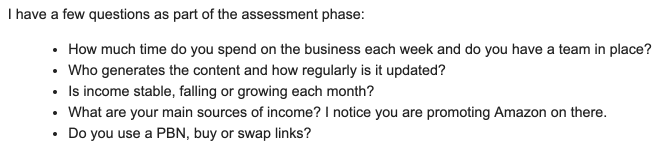

With FEI, you get an email very quickly after submitting their form asking you a set of questions about the business for them to assess if it meets their listing criteria.

Pretty standard stuff that you should be able to answer, so no surprises there.

After sending back your answers, you are asked for a P&L for the site. If you don’t have one, then you are given an Excel P&L template to fill out for their valuation team.

Once you send the P&L back, you have to wait for the Valuation team to run the numbers to see what price and multiple they can list it at. This can take a few days and the response you get is very detailed as to how they came up with the figure they give you.

They even tell you how long they think it will take to sell the site based on similar listings they’ve sold.

This process with FEI only takes a few days, in my experience.

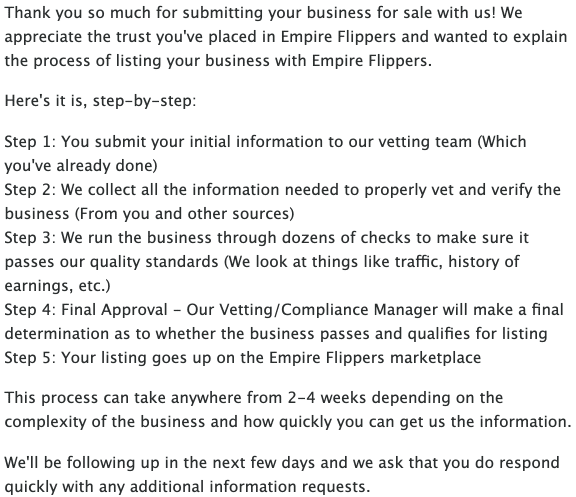

With EF, once you submit and pay, a support ticket is created in their system that gets the ball rolling. Someone almost immediately updates that with what you can expect.

And not too long after that, you get another update with an expected date for your listing to go live on their marketplace, as well as everything that they need access to in order to vet the site and give it a valuation.

They also send you a list of around 30 questions to answer about your site. Once you answer those, a Vetting Specialist appears in the ticket to let you know that vetting has started. You may get more questions from this person (I did).

The Vetting Specialist builds out your P&L for you and is the person who delivers your valuation and multiple for the listing. The time that this takes varies. For me, it took almost two weeks from when I submitted to EF.

- EF asks you more questions before the valuation.

- FEI requires you to compile your own P&L (this took me 3 hours), where EF compiles it for you and then you check for accuracy.

- The time to get a valuation typically seems to take longer with EF.*

*This was not my first time selling a site with either of these brokers, however this is the first time that it took more than a month for me to get a valuation from FEI.

Crickets.

I sent a follow-up a few days later.

Crickets.

About a week later, my previous listing manager reached out to me on Skype to let me know that she’d seen my site submission and would follow-up on it. She also invited me to a client dinner at a conference and dropped a link to where I could buy a ticket to said conference and dinner.

A month goes by and no further contact from FEI.

I use their form again and use the other website that I wanted to package for this deal with a little note about what has happened. This time, I get that valuation.

What fell apart here? I have no idea cause my other experiences with FEI were not like this.

Agreeing To The Listing Terms & Going Live

After you get your valuation from the broker, you get to decide if you really want to list your site with them or not.

If you agree to go with FEI, then your exclusivity is 90 days from when the listing goes live.

If you agree to go with EF, then your exclusivity is six months from when the listing goes live.

Since the earlier processes are slight different between the brokers, what follows next after agreeing to list with them is also slightly different.

With FEI, you have to sign a formal representation agreement, which is then followed by a very lengthy business questionnaire. I can’t remember how many questions it is, but it’s around 100 of them. Expect to spend a few hours on this.

Next up with FEI is the financial due diligence. For my most recent experience with FEI, I got a follow up about a week later asking questions like:

- How much do I pay my writer per word?

- How much do I pay for guest post outreach?

- What are my monthly tasks for the site?

At this point it’s just answering questions and uploading things like proof of income.

Once that’s done, they compile a prospectus on the site to show prospective buyers. All in, that took a couple of weeks for me.

Before being listed live on their site, FEI does circulate your business with their rolodex of prospective buyers. It could sell without ever going live on their site.

With EF, when the Vetting Specialist gives you the valuation all you have to do is respond that you’re good with it. In my experience, your listing then goes live the next week.

- Exclusivity is 90 days from live listing with FEI and six months with EF.

- There is a more formal process with FEI with the signing of the representation agreement.

- FEI prepares a prospectus for the listing, and EF does not.

- You could sell your site with FEI without the listing ever going public.

Your Site Is Listed And Getting Offers

In my experience, as soon as your listing is live with either broker, you start getting a lot of interest on day one.

Most of the interested parties are not going to make an offer. Sometimes you get an immediate offer, and sometimes you end up going back and forth for a few weeks before getting an offer.

Fielding questions and offers from potential buyers is slightly different between the two brokers.

With FEI, that massive questionnaire you fill out does the job of eliminating most questions that arise. However, if there are any other questions, then they arrive for you by email.

In my experience, you’ll either get an offer from someone ready to buy or someone who is interested but wants to secure a little more time for due diligence. If the latter happens, then you will get a formal letter of intent.

You may also end up with an interested party who wants to get you on the phone to ask more questions.

In my experience, FEI sets up the call for you and they stay on mute for the duration of the call. It’s just you and the interested buyer going back and forth.

With EF, since they don’t ask quite as many questions up front, you end up getting a lot more questions from interested parties. These questions come through your ticket and you can experience multiple EF employees sending them through.

It can be a lot to keep up with, so you have to be careful that you don’t accidentally skip over any questions that come through to you.

In my experience, you can get someone making an offer or you can get someone who wants to get you on a call for more questions.

With EF, the buyer call process is a bit different. Before the call starts, there is a 30-minute call between just you and EF to prepare you for the buyer call.

The EF representative will tell you what to expect, give you some tips, and answer any questions you might have.

During the call, the EF representative is on the line and chimes in when needed.

Once the call is over, you stay on with the EF representative to discuss how it went and what you can expect to happen next in the process.

- EF does before and after one-on-one support with you for potential buyer calls.

- FEI has more formal LOI options for interested buyers who want more due diligence time.

- There tends to be more questions from interested buyers with EF than FEI (based on my experience).

Accepting An Offer & Selling The Site

The best part of all of this is getting an offer that you like and selling it for that big payout. The end process does differ between the two brokers, so here’s how it will go for you.

With FEI, when you want to accept an offer you have to complete a formal purchase agreement with the buyer.

Escrow.com is used to secure the payment for your site sale, with the seller and the buyer splitting the cost of the escrow transaction fees.

FEI does not migrate the site for the buyer.

Instead, FEI sets up a Skype chat with the seller, the buyer, and your FEI agent. Within this Skype chat, you and the buyer work together to get the business migrated over to him/her.

Since Escrow.com is used to manage the money, it has to be updated by each party. So, the buyer has to confirm with them that the site was received. The inspection period only begins once this is done – in my experience it is up to the seller to make sure that this moves along at a reasonable pace.

The inspection period is 2-3 days via Escrow.com. The buyer can confirm everything is okay, or once that period expires Escrow.com assumes everything is good and releases your money.

You are paid out into the account you use with Escrow.com, minus the 15% commission fee that FEI takes and 50% of the transaction fees that go to Escrow.com.

Once you accept an offer with EF, they let all of the other depositors know that you did so. This begins a 24-hour clock for any other interested depositors to make an offer. (I have no idea if FEI does this as well.)

The offer must be 10% higher than what you accepted. This is true even if you have negotiated with a depositor for a sales price lower than list price.

Once you know that you’re on the final offer, a migrations ticket is opened by the EF migrations team. They have a checklist of things to complete, which they give you access to so that you can keep up with the process.

The migrations team takes care of moving your site to the buyer’s web host. The time that this takes varies.

Once the site gets migrated, the inspection period starts. EF gives the buyers up to two weeks to confirm that everything looks okay with the site.

Once the buyer confirms that it’s all good on their end, EF asks you how you want paid out (since they act as escrow for the transaction). You can get it wired to your bank account or even get paid out in bitcoin.

Like FEI, you also pay a 15% commission to EF for selling your site (if the transaction is under $1 million).

- FEI has a formal purchase agreement for sales.

- EF migrates the site for you and the buyer.

- With FEI, the buyer and the seller are responsible for splitting the cost of the escrow transaction fees.

- With FEI, the buyer gets 2-3 days to inspect the site via escrow.com terms while EF gives the buyers up to two weeks.

- EF acts as escrow and gives sellers multiple payout options, including bitcoin.

- EF has a tiered commission structure.

Final Thoughts

As you can see, these two brokers have a lot in common but there are still a few key differences.

I’m trying to keep this as unbiased as possible, so I’m not going to reveal my preferred broker to you. However, there are a few other differences between the two that might interest you.

- The EF team is remote and they don’t seem to have any real office.

- The FEI team seems to be scattered around a few different offices, with the main two being in London and New York City.

- They each seem to have different valuation models that are proprietary. You can get a rough idea of EF’s valuation with their online tool.

I also want to point out that there are other brokers you can use, or you can even go for a private sale. I’ve sold plenty of sites in Facebook groups – you just gotta be careful when doing a private sale.

At the end of the day, when you’re picking a place to list your site for sale I think you should consider the following:

- Where will I get the best valuation?

- Who has the best rolodex of qualified buyers for my site?

- Who can best market my site listing for me and give me the support I need for this sale?

So, decide what works best for you when you get ready to sell a site. Good luck!

Hey, I’m Shawna. I make a living working from my laptop in places like London, Sydney, Dubai, Rome, Oslo, Bangkok, Las Vegas, Barcelona, and Amsterdam. I share how I do some of that on this website.